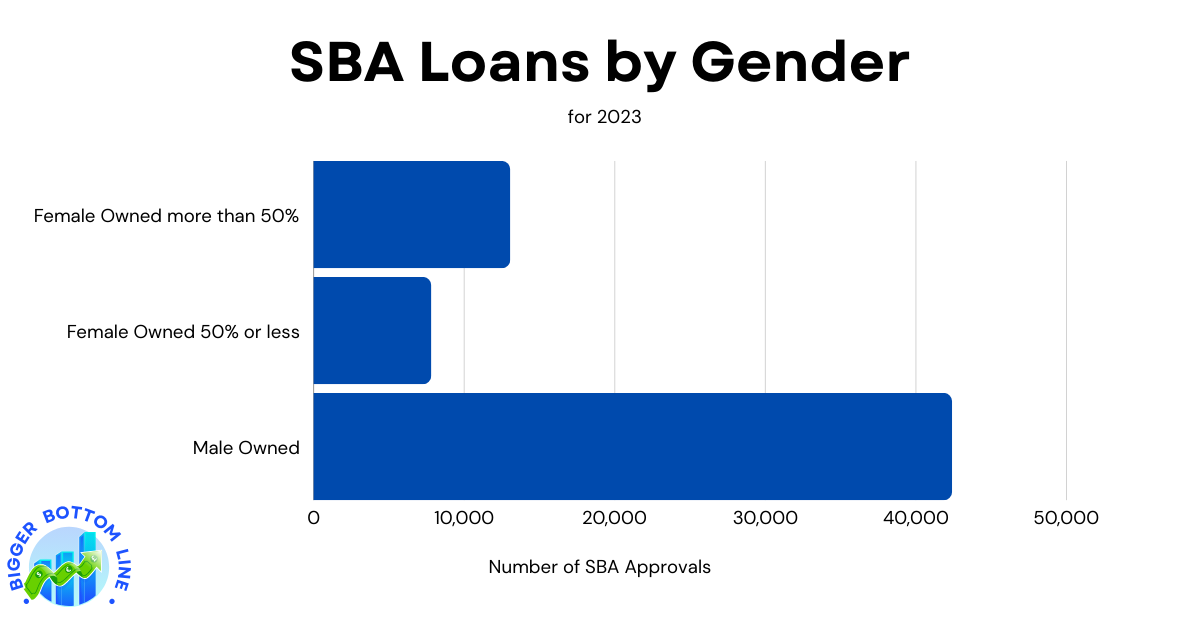

The 2023 Small Business Administration (SBA) loan data reveals significant disparities in lending distribution across gender lines. Male-owned businesses dominated the lending landscape, receiving 42,406 loans, which represents approximately 67% of all SBA loans distributed that year. In comparison, businesses with majority female ownership (more than 50%) received 13,062 loans, accounting for roughly 21% of the total. Businesses with partial female ownership (50% or less) received the smallest share with 7,818 loans, representing about 12% of the total distribution.

This data highlights a considerable gender gap in SBA lending practices, with male-owned businesses receiving more than three times the number of loans compared to businesses with majority female ownership. When combining both categories of female ownership, women-owned businesses received a total of 20,880 loans, still less than half of what male-owned businesses received. This disparity suggests potential barriers to access for female entrepreneurs or could reflect broader patterns in business ownership demographics and loan application rates.