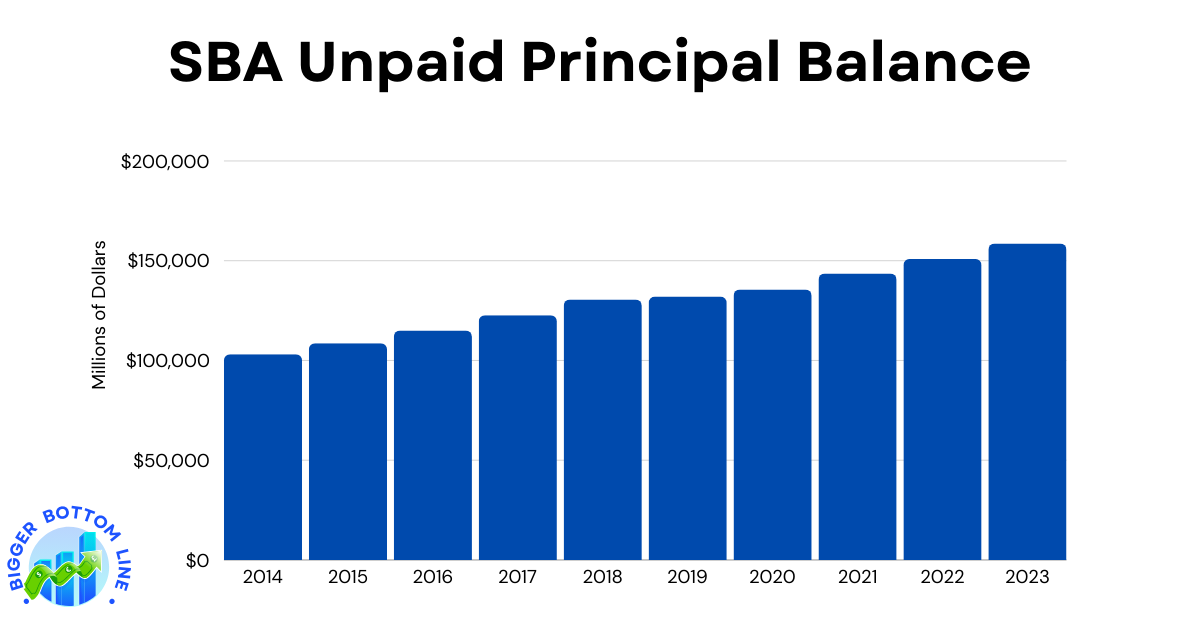

The Small Business Administration’s (SBA) Unpaid Principal Balance has shown consistent growth over the past decade, reflecting an expanding portfolio of small business loans. From 2014 to 2023, the UPB increased by approximately $55.5 billion, representing a 53.8% growth over this period. The data shows a steady year-over-year increase, with the UPB starting at $103.1 billion in 2014 and reaching $158.6 billion by 2023.

Notable patterns in the data include a relatively consistent growth rate in the pre-pandemic years (2014-2019), with annual increases averaging about $5-7 billion. The growth continued through the COVID-19 pandemic years, with particularly significant jumps between 2020-2023, where the UPB increased by about $23 billion in just three years. This acceleration in growth likely reflects the increased demand for SBA loans during and after the pandemic, as well as various federal relief programs implemented during this period.