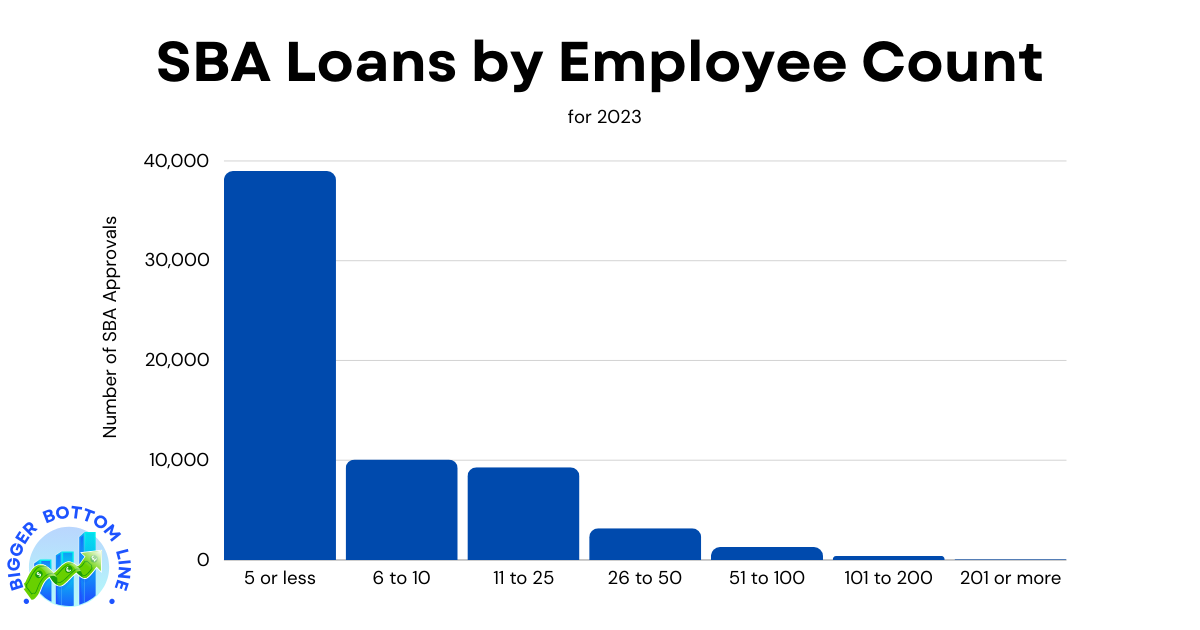

The 2023 Small Business Administration (SBA) loan data reveals a clear pattern in lending distribution across different business sizes. The overwhelming majority of SBA loans were granted to very small businesses, with companies employing 5 or fewer people receiving 38,988 loans, representing approximately 62% of all loans distributed. This significantly outpaces all other business size categories combined.

The data shows a consistent downward trend as employee count increases. Businesses with 6-10 employees received 10,083 loans, while those with 11-25 employees secured 9,285 loans. The numbers continue to decrease substantially for larger businesses, with only 63 loans going to companies with 201 or more employees. This distribution aligns with the SBA’s core mission of supporting small businesses and startups, particularly those that might have difficulty securing traditional financing due to their size and limited operating history.