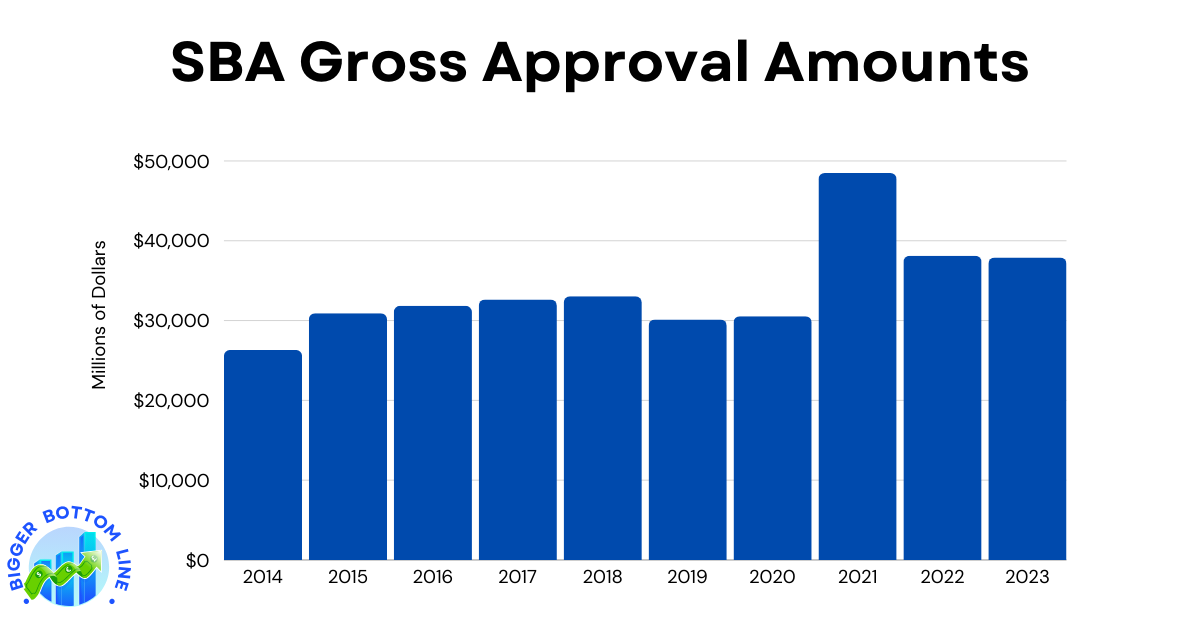

The Small Business Administration’s (SBA) gross approval amounts demonstrate interesting trends over the past decade. From 2014 to 2018, there was a steady upward trajectory, with approvals growing from $26.3 billion to $33 billion. The years 2019 and 2020 saw a slight decline to around $30 billion, likely due to economic uncertainties. The most notable feature in the data is the dramatic spike in 2021, when approval amounts reached an unprecedented $48.5 billion, representing a nearly 59% increase from the previous year. This substantial increase can be attributed to the increased SBA lending activity during the COVID-19 pandemic and associated economic recovery efforts. Following this peak, approvals decreased but stabilized at a new, higher baseline of around $38 billion in 2022 and 2023, still significantly above pre-pandemic levels. This suggests a lasting expansion of SBA lending activity compared to the pre-2020 period.