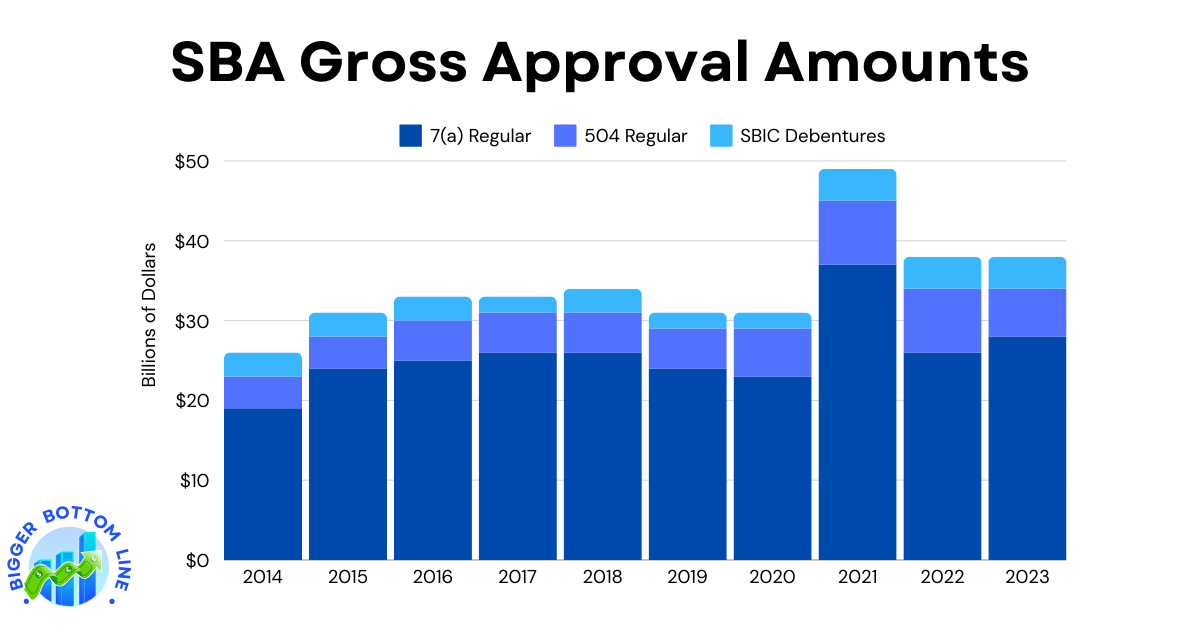

The Small Business Administration’s lending programs show interesting trends over the past decade (2014-2023). The 7(a) Regular loan program, which is SBA’s primary lending program, has been the dominant funding source throughout the period. It maintained relatively stable approval amounts between $23-26 billion from 2014-2020, before experiencing a significant spike to $37 billion in 2021, likely due to increased pandemic-related lending activity. After 2021, the program returned to more typical levels, settling at $28 billion in 2023.

The 504 Regular loan program, which provides long-term, fixed-rate financing for major fixed assets, has shown steady growth over the period. Starting at $4 billion in 2014, it gradually increased to $8 billion in 2021-2022, before decreasing to $6 billion in 2023. The SBIC Debentures program has remained the smallest of the three, maintaining relatively consistent approval amounts between $2-4 billion throughout the period, with slight fluctuations but ending at $4 billion in 2023.maintaining relatively consistent approval amounts between $2-4 billionmaintaining relatively consistent approval amounts between $2-4 billion