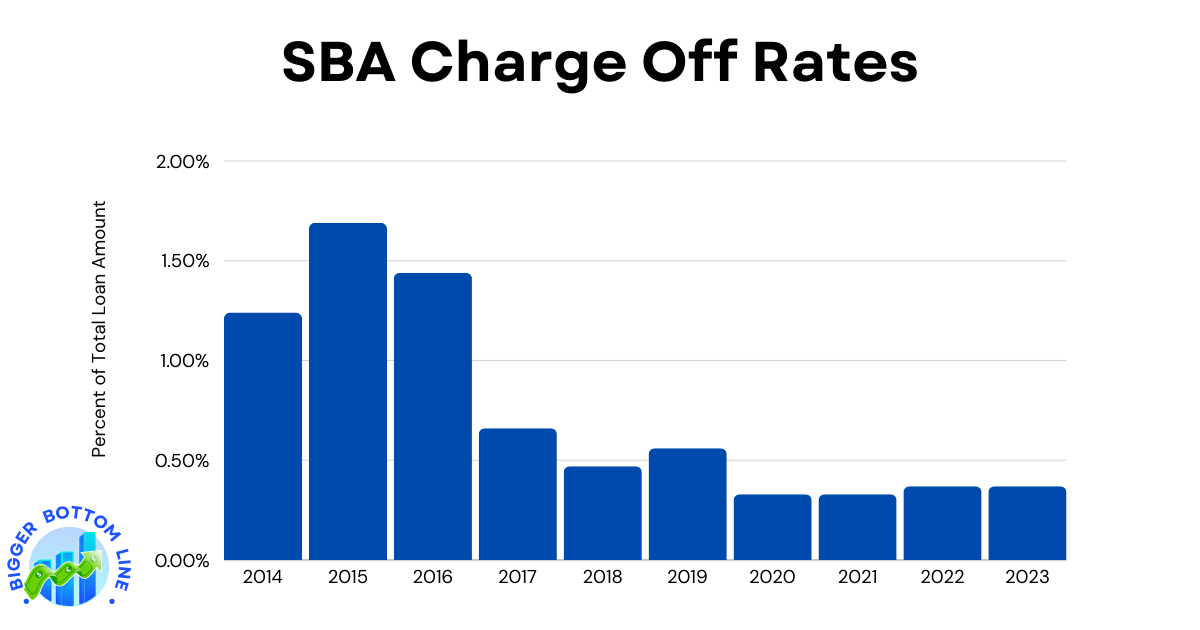

The Small Business Administration’s (SBA) charge-off rates, which represent the percentage of unpaid principal balance that has been written off as uncollectible, have shown a significant improvement over the past decade. The data reveals that charge-off rates peaked in 2015 at 1.69%, followed by a steady decline through 2020. Between 2014 and 2015, there was a notable increase from 1.24% to 1.69%, but this was followed by a sharp downward trend, with rates dropping to 0.66% by 2017 and continuing to decrease.

The most recent years show remarkable stability in charge-off rates, with 2020 and 2021 both maintaining a rate of 0.33%, followed by a slight uptick to 0.37% in 2022 and 2023. This stabilization at historically low levels suggests improved loan performance and more effective risk management practices in SBA lending programs. The overall trend from 2014 to 2023 represents a roughly 70% decrease in charge-off rates, indicating significantly better loan performance and reduced risk for SBA lenders.