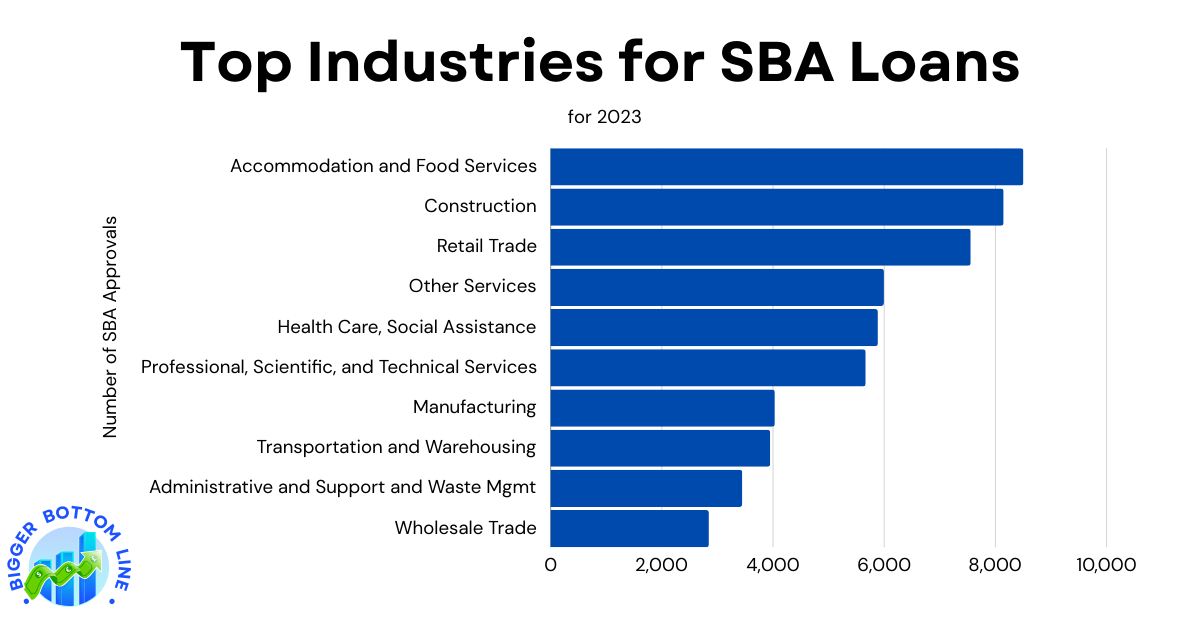

The Small Business Administration (SBA) loan data for 2023 reveals that service-oriented industries dominated lending activity. Accommodation and Food Services topped the list with 8,504 loans, likely reflecting the continued recovery and expansion of restaurants and hospitality businesses post-pandemic. Construction followed closely with 8,148 loans, indicating strong growth in building and development sectors. Retail Trade secured the third position with 7,556 loans, demonstrating significant support for brick-and-mortar and online retail businesses.

The middle tier of recipients included Other Services (5,995 loans), Healthcare and Social Assistance (5,886 loans), and Professional, Scientific, and Technical Services (5,667 loans). Manufacturing, Transportation and Warehousing, Administrative Support, and Wholesale Trade rounded out the top 10, with loans ranging from 4,032 to 2,846. This distribution suggests that while traditional service industries remain the primary beneficiaries of SBA lending, there’s substantial support across diverse sectors of the American economy.