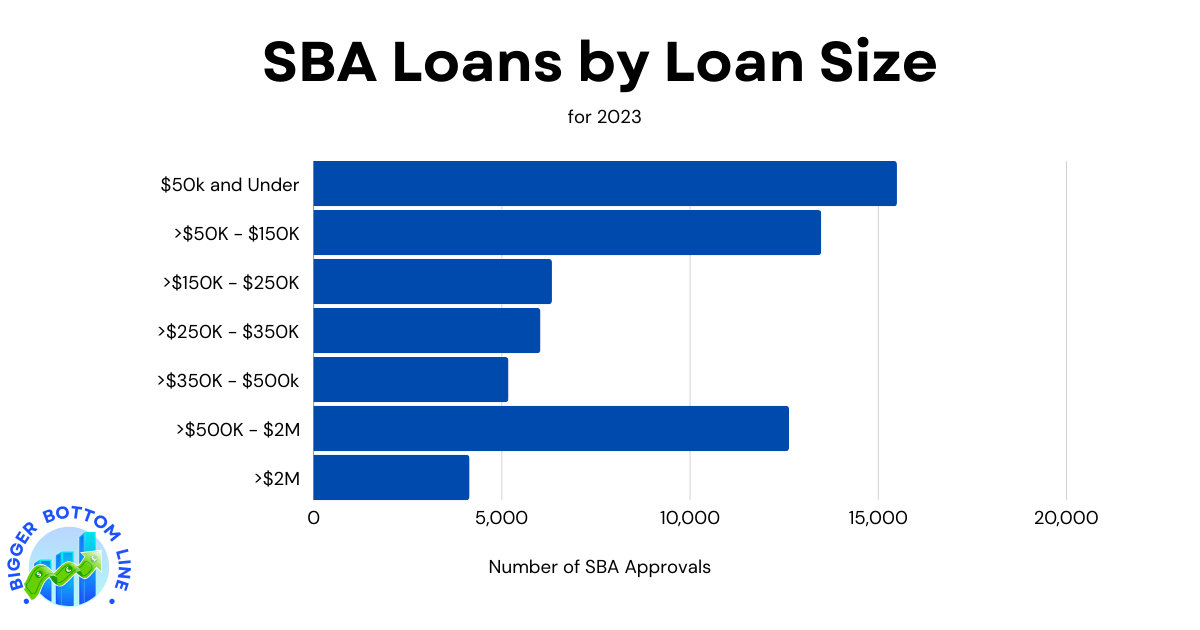

The 2023 Small Business Administration (SBA) loan data reveals interesting patterns in lending distribution across different loan size categories. The data shows that smaller loans dominated the lending landscape, with 15,496 loans of $50,000 or less representing the largest segment. This was closely followed by loans in the $50,000-$150,000 range, accounting for 13,485 loans. Together, these two categories represent nearly 44% of all SBA loans issued in 2023.

The middle ranges, spanning from $150,000 to $500,000, show a relatively consistent distribution, with each category averaging around 5,000-6,000 loans. However, there’s a notable spike in the $500,000-$2 million range, with 12,630 loans, making it the third most common category. The least frequent category was loans exceeding $2 million, with 4,142 loans, suggesting that while the SBA does support larger lending amounts, its primary focus remains on smaller to medium-sized business loans.