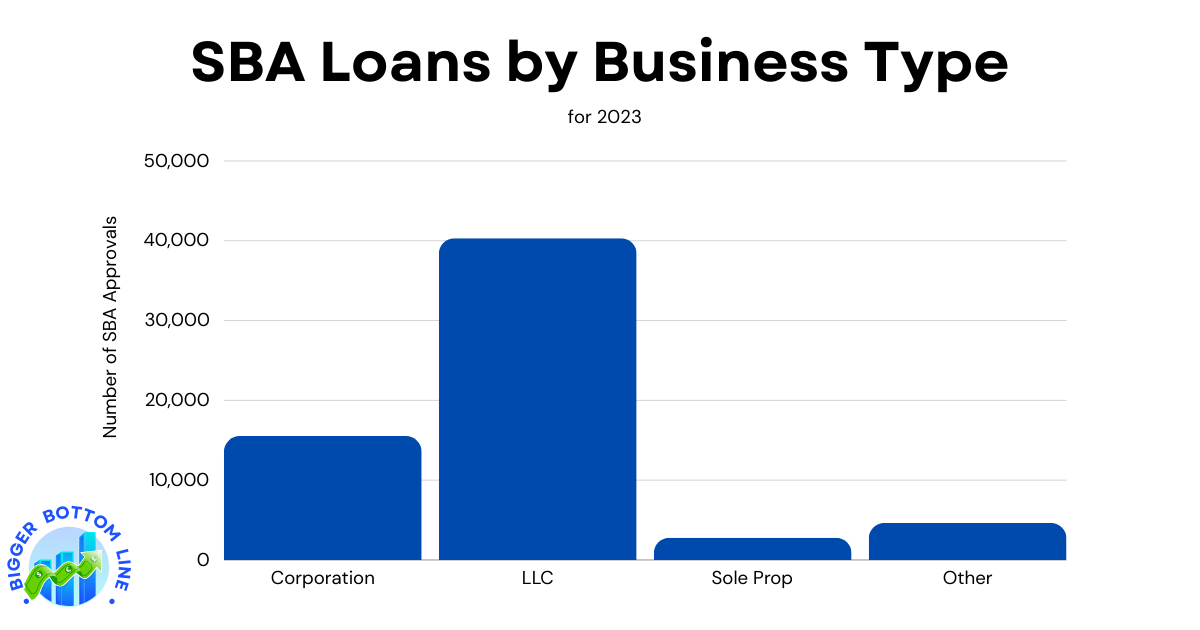

The 2023 Small Business Administration (SBA) loan data reveals a clear preference for Limited Liability Companies (LLCs) among loan recipients. Out of the total 63,286 loans distributed, LLCs dominated the landscape with 40,325 loans, representing approximately 64% of all SBA loans issued that year. Corporations ranked second with 15,521 loans (about 25% of the total), while Sole Proprietorships received the smallest share with 2,798 loans (4%).

This distribution likely reflects both the popularity of LLC structures among small businesses and the perceived stability of this business format by lenders. The significant gap between LLC and Sole Proprietorship loans (a difference of 37,527 loans) suggests that formal business structures may have an advantage in securing SBA funding. The “Other” category, accounting for 4,642 loans, likely includes partnerships, S-corporations, and other less common business structures.