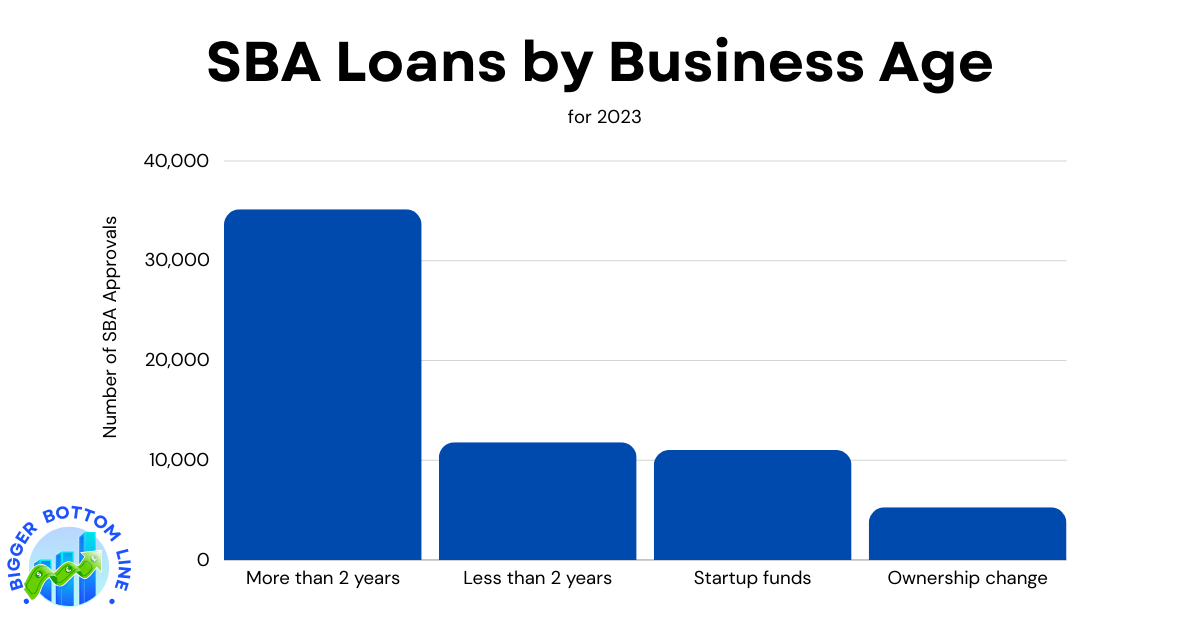

The 2023 Small Business Administration (SBA) loan data reveals that established businesses were the primary beneficiaries of SBA lending programs, with businesses operating for more than two years receiving 35,149 loans, representing approximately 56% of all loans distributed. This significant majority suggests that lenders tend to favor businesses with proven track records and established operations.

The remaining loans were fairly evenly distributed between newer businesses (less than 2 years old) and startups, receiving 11,807 and 11,029 loans respectively, each accounting for roughly 19% of total loans. Business ownership changes received the smallest portion with 5,277 loans, or about 8% of the total. This distribution pattern indicates that while the SBA program strongly supports established businesses, it maintains a substantial commitment to fostering new business growth and entrepreneurship through startup and early-stage business funding.