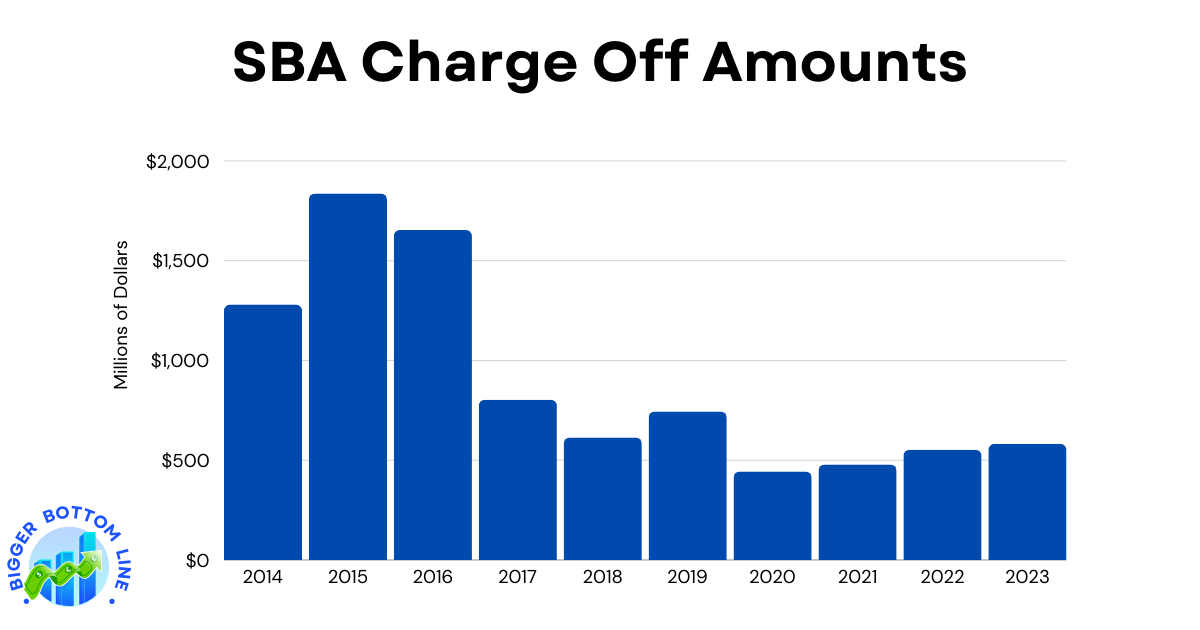

The Small Business Administration’s charge-off amounts show significant fluctuation over the ten-year period from 2014 to 2023. The data reveals a notable peak in 2015, when charge-offs reached $1.837 billion, followed by a gradual decline in subsequent years. After 2015, there was a sharp downward trend, with charge-offs dropping to $803 million in 2017 and continuing to decrease to a low of $444 million in 2020. The most recent years (2021-2023) show a slight upward trend, but amounts remain relatively stable, hovering between $479 million and $582 million, significantly lower than the levels seen in the mid-2010s. This overall decline in charge-off amounts could suggest improved loan performance, more stringent lending standards, or better economic conditions for small businesses during this period.